Content

It measures the value of net profit a company obtains per dollar of revenue collected. The higher the net profit margin, the more profitable the business is. Net profit margin measures how much net profit is generated as a percentage of revenue. Total revenue refers to the total amount of sales earned during the accounting period.

Net income can be distributed among holders of common stock as a dividend or held by the firm as an addition to retained earnings. As profit and earnings are used synonymously for income (also depending on https://www.bookstime.com/ UK and US usage), net earnings and net profit are commonly found as synonyms for net income. Often, the term income is substituted for net income, yet this is not preferred due to the possible ambiguity.

Accounting equation

If they look at net income instead and make sure budgeted spending is below their net income, they could instead start saving money for the future. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site.

Earnings are your company’s profits after expenses and liabilities, including taxes. Working capital balance changes reflect increases or decreases in the use of cash by a business. Variable costs are direct costs that vary with the volume level.

Where to record net income

Making the decision to study can be a big step, which is why you’ll want a trusted University. We’ve pioneered distance learning for over 50 years, bringing university to you wherever you are so you can fit study around your life. Enrol and complete the course for a free statement of participation or digital https://www.bookstime.com/the-accounting-equation badge if available. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns. You’re obviously an interested investor if you’re reading this…

- She is a former CFO for fast-growing tech companies and has Deloitte audit experience.

- This will reduce the profit created by £30 as well as reducing cash.

- Businesses use net income in financial modeling to predict their future performance based on past performance.

- The net profit can be paid out to owners or reinvested in the business.

Your gross income takes into account any additional income from other sources, like interest on cash in the bank. In this post, you’ll learn how to use the net profit formula to calculate the net profit for your company, even if you are not an accountant. Debits and credits are used in double-entry accounting to keep the basic equation of accounting in balance. Debits and credits are used with each transaction and total debit must equal total credits. For the individual, net income is the money you actually get from your paycheck each month rather than the gross amount you get paid before payroll deductions.

What is the Difference Between Net Income vs. Cash Flow?

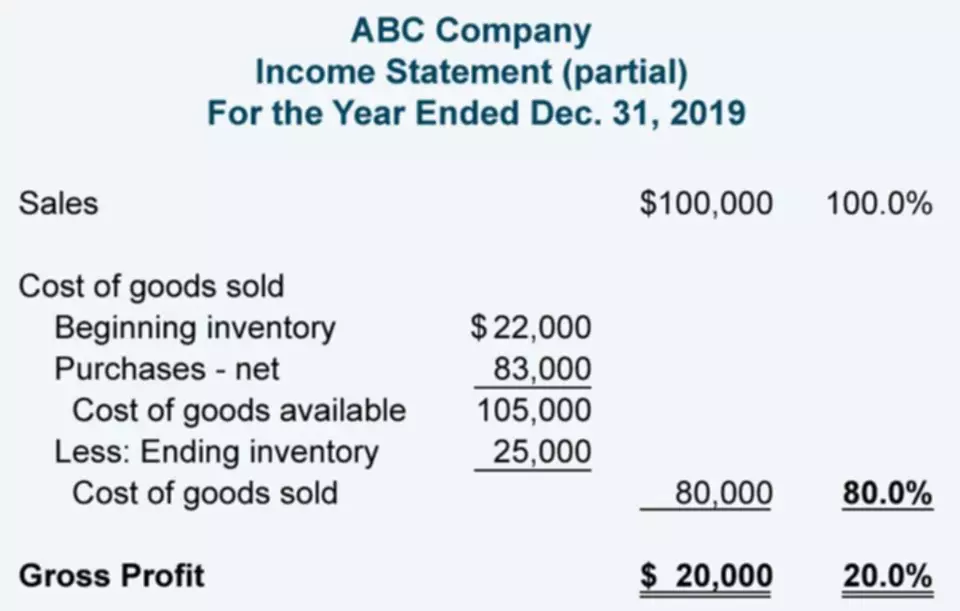

(Check out our simple guide for how to calculate cost of goods sold). Net profit is the money a company earns after deducting all expenses from revenue. On the other hand, the cash basis method only recognizes revenue and expenses when cash is exchanged. They typically differ because of the two distinct accounting methods used by businesses to calculate them – accrual basis or cash basis.

- We are an independent, advertising-supported comparison service.

- Right below the net profit line item, we can also see a separate section where the earnings per share (EPS) are calculated on a basic and diluted basis.

- It’s entirely possible to calculate net income from assets, liabilities, and equity, and these are the three ways to do it under three different scenarios.

- Incoming revenue is vital to business growth, but it doesn’t paint the most accurate financial picture of your business.

- Knowing how to calculate net profit is essential for business owners and investors.

- Income statements—and other financial statements—are built from your monthly books.

- Revenue is not a reliable indicator of business profitability; net profit is.

A company with positive net income is more likely to have financial health than a company with negative net income. Some small businesses try to operate without preparing a regular income statement. It’s not enough just to take a look at your bank balance and expenses on your check register. Conversely, many companies are required to meet certain profits each year in order to maintain loan covenants with their lenders. On one hand, management wants to show less profit to reduce taxes.

An equation for net income

Noncurrent assets may include noncurrent receivables, fixed assets (such as land and buildings), intangible assets (such as intellectual property), and long-term investments. Net profit is calculated by subtracting all expenses from revenue. Gross profit is the revenue a company earns minus the cost of goods sold. Net profit is the revenue minus cost of goods sold, operating expenses, and all other expenses incurred by the business. There are various ways businesses can increase their net profit, such as reducing unprofitable products or services, conducting market research to review pricing, or reducing direct and overhead costs. Net profit measures how much money remains after expenses are subtracted from revenue.